A recent State of AI report from Dataiku found that despite 75% of senior AI professionals reporting a positive Return on Investment (ROI) from AI, more than half (55%) of respondents say they are more worried than excited about AI.

While more than 60% of global data leaders said they already have Generative AI baked into their plans, 69% of data leaders in APAC said the same. While 29% of APAC data leaders said they are embedding AI into the DNA of their businesses, only 18% in Europe and 20% in the US said the same.

Dataiku regional vice president for Asia Pacific & Japan (APJ), Grant Case recently spoke to Retailbiz about why APAC businesses are leading the AI charge, as well as providing insights into Dataiku’s journey and growth direction.

“Our customers, especially in the retail industry, are dealing with a lot of complexity because there’s data in all different locations with different personas that are trying to work with each other,” he said.

“We’ve found that when we can bring different people together from different backgrounds – from data scientists to retail managers and domain experts – they can achieve better results. Our business is founded upon – the idea of building better analytics across data sets to generate better results.”

Case has been in Australia for the last four years leading the APJ team, having immigrated from the US to Australia, and since then, the use of AI has accelerated significantly.

“Just two years ago, close to one in four (39%) APAC organisations were using AI and now it’s exploded, particularly on the back of the Covid pandemic. We’re seeing organisations in APAC become less fearful of AI when compared to their global counterparts across the world,” he explained.

“Our State of AI report revealed that 60% of global leaders are using generative AI compared to 69% of APAC leaders because a lot of organisations can see what’s worked well in other countries such as the US and are taking those results and running with them.”

AI in retail

Almost all (93%) Australian retailers cite customer experience as either ‘important’ or ‘critical’ and in the Dataiku report, CPG refill respondents were the second highest industry use case of AI at 67%, only behind healthcare at 76%.

“Retailers are looking to take machine learning (ML) and data science to the next level,” Case said.

“There’s been a traditional set of use cases around demand forecasting and out-of-stocks – which are critical to a retailer’s success – but now they are turning their attention to the customer experience journey. No other industry has better knowledge base of the customer buying cycle and process than retailers, and they’re now turning to AI for these experiences.

“For me, the customer journey becomes the new critical use case we’re seeing. By using generative AI, there’s no better way to understand what a customer is saying, whether it’s in a survey or the knowledge being exchanged on social media about particular retailers or products, then using large language models (LLM), and I believe they’re going to be part of the process for every retailer.”

Among smaller retailers, ML and data science, as well as generative AI, is seen as a way to get ahead. “They’re applying Dataiku as part of this process because ultimately data is the lifeblood for a lot of these organisations. A major concern for many retailers is the cookieless future and they are looking at how they can start using psychographic information to better understand customers.

“Small retailers put themselves in a better position – and better bargaining position – when they know more about their customer. This is something that differentiates them and builds out advanced analytics. By bringing these capabilities in house or working with a local partner, the return of investment (ROI) of these programs is north of 40 to 50%, on average.”

Evolution of Dataiku

As an organisation and platform, Dataiku wants to be used by everyone in the organisation but removing the need for each individual to understand the technology behind it.

“Many organisations are moving to platforms such as Snowflake and Databricks in order to bring in more types of data and better understand their customers. At Dataiku, we’ve been listening to our customers and they bring these use cases to us – standard out of the box capabilities,” Case said.

“We’ve put together what we refer to as business solutions, from a retailer accelerator pack with solutions such as Recency, Frequency and Monetary Value (RFM) segmentation, customer lifetime value, distribution and spatial footprint.

“Margins aren’t getting any better and the majority of retailers are pushing higher costs onto consumers, but some of the smaller retailers are holding back in an effort to gain market share. Part of what we’re trying to do is put these out-of-the-box solutions in place for organisations because it’s about speed and value. I think for us, it’s bringing more subject matter expertise, more out-of-the-box solutions and then ultimately ensuring that these new technologies are being used by more retailers.”

Dataiku recently held its Everyday AI conference in New York, an opportunity to host many clients and make a number of key announcements.

“One of the key trends for us has been the explosion in generative AI, particularly over the last six months. I’ve been in the retail sector for 20 years and I’ve never seen a technology catch fire this fast. Executives that don’t usually get involved in technology now know what this means,” Case said.

“We see a future with a lot of different AI models – retailer-based models and finance-based models – that can be brought into any project, but also deliver on the cost and orchestration.

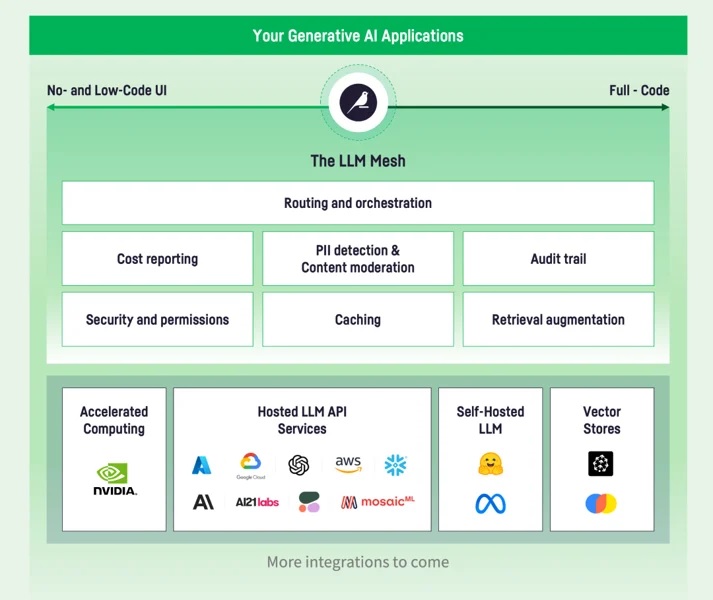

“Just over one-third (37%) of Australian shoppers thought AI was going to have a positive impact, but three-quarters of them wanted personalised recommendations. We’ve put forward this concept of the LLM Mesh – how organisations can understand large language models (LLM) and things to orchestrate Personally Identifiable Information (PII) detection, ensuring security and permissions, as well as using the right brand name, image and recognition. We want to ensure that AI is scaling correctly and being used responsibly.”

In conclusion

Case believes that retailers have the best data available to them and the biggest opportunity to improve their operations with the use of AI and ML. “Retailers also have an opportunity to develop a better set of conversations with their customers, in and around these new technologies, like generative AI,” he said.

“For those working out how they can best leverage AI because there’s a lot of fear of missing out, but they’re not alone because many people are on this journey. Retailers should at least have a strategy and begin discussions because if you’re not doing it, another retailer is. It’s no longer a question of if, but when, and it’s likely already in your organisation today.

“If you’re looking for places to apply AI, marketing and sales is number one, but don’t discount customer service, particularly chatbots. It’s just a matter of getting started and being intentional. Sitting down and having a conversation with your teams about where customer data lives, such as online surveys, is a great place to start your generative AI process.

“Getting literate in AI is something you should be doing because it’s going to put you ahead.”