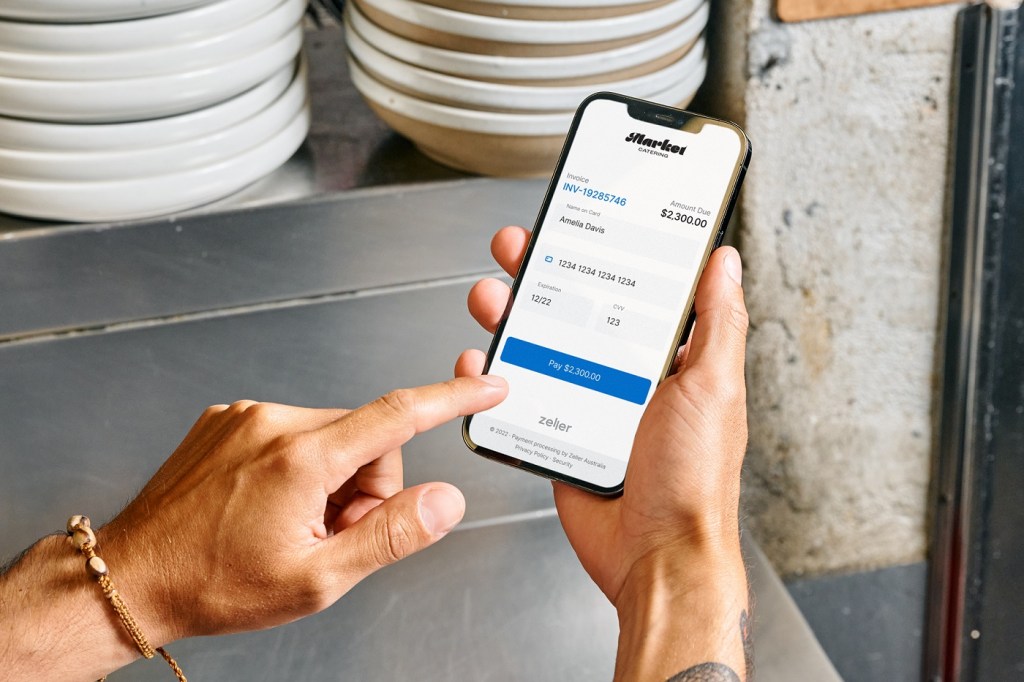

Australian fintech, Zeller has launched its online invoicing solution, enabling business owners to send online invoices, automate reminders, track payment history, as well as accept payment via Zeller’s new online payment gateway.

The launch complements Zeller’s recently expanded offering into new financial services solutions, including standalone business transaction accounts and debit cards, replacing the functionality of a traditional business bank.

Currently, most of Australia’s incumbent banks do not provide online invoicing as part of their banking offering, requiring businesses to look for an alternative, disparate provider to send and get invoices paid.

“We’re excited to add Zeller Invoices to our growing product suite, which helps Australian business owners manage finances and payments more easily,” Zeller co-founder and CEO, Ben Pfisterer said.

“This product simplifies payment processing, reduces late payments, and saves time, all without any monthly fees or lock-in contracts. With a low card processing rate, businesses can save money and get paid faster.”

A recent report from Accenture and Xero found that 48% of invoices in Australia were paid late, with the average being paid 6.4 days late – costing Australian small businesses $1.1 billion per year.

Thousands of invoices have been sent using Zeller Invoices in the past seven weeks, which are being paid in an industry-leading 1.5 days – significantly shorter than the government’s reported average of 33 days to pay. In addition, 89% of invoices sent through Zeller are being paid before, on, or one day after their scheduled due date.