After coping reasonably well in 2023 despite challenging macroeconomic conditions, there has been a slowdown in sales and wages growth is driving softer performance, according to the latest Xero Small Business Insights (XSBI) covering October to December 2023.

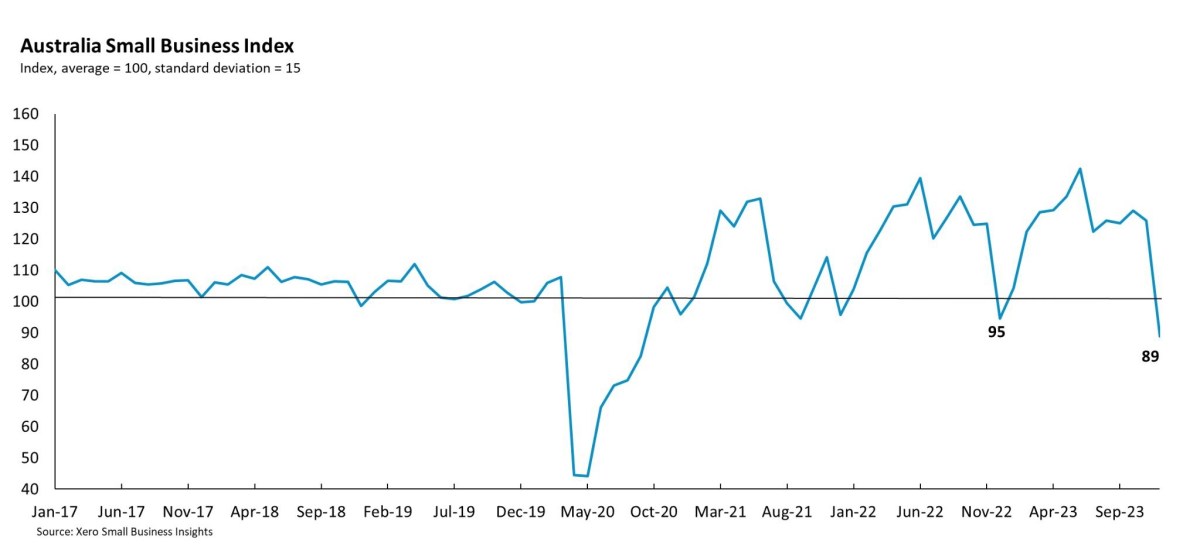

The Xero Small Business Index averaged 115 points in the December quarter, down 10 points from theSeptember quarter. A significant shift was seen in December when the Index fell 37 points to 89 points,its lowest level since September 2020 and the first time in a year the Index has dropped below the 100level. This is the largest single month decline since April 2020, when the economy was essentially closeddown by the pandemic.

During the three-month period, sales growth averaged 5.1% y/y for the December quarter (6.8% y/y for September quarter), wages growth averaged 3.0% y/y for the December quarter (2.8% y/y for September quarter) and jobs growth averaged 3.5% y/y for the December quarter (2.7% y/y for September quarter).

Xero economist, Louise Southall said, “Multiple interest rate rises and higher-than-usual inflation are impacting household budgets and we can see a shift in the December data, particularly in the retail sector. It’s important to acknowledge that the soft December result happened when retailers and hospitality businesses, in particular, expect to be busy with heightened consumer activity.”

This result contrasts the upward trend seen at a national level, with the wage price index (WPI) rising 0.9% in the December quarter and 4.2% in the 12 months to December, suggesting that small business owners are currently unable to compete with larger businesses on pay increases.

South Australia (+3.5% y/y) and Tasmania (+3.4% y/y) showed the largest wage gains in the December quarter, while the hospitality sector (4.0% y/y) recorded the largest increase across the industries.

The drag on the Index from sales and wages was partially offset by a modest pick-up in jobs growth in the final few months of the year. Jobs growth (3.5% y/y for the December quarter) was above the pre-COVID average for this series (3.0% y/y) and showed a moderate increase when compared to the September quarter (2.7% y/y). The hospitality workforce experienced a fall in jobs in the December quarter (-1.2% y/y), while healthcare (9.5% y/y) and education and training (6.6% y/y) had the fastest growing staff levels. Across the regions, jobs gains were led by Western Australia (6.3% y/y), while Tasmania only managed average jobs gains of 0.2% y/y.