PayPal has confirmed the availability of its PayPal Pay in 4 no-fee buy now pay later (BNPL) solution to eligible customers in Australia.

Since it was first announced in March, PayPal has made key updates to the solution ahead of the consumer launch including no late payment fees, in addition to being interest-free, and reducing the minimal value for purchases from $50 to $30 for consumers to split the cost of eligible purchases into four interest-free payments.

According to recent research commissioned by PayPal, more than half (55%) of Australian online shoppers have not used BNPL with 50% citing high late fees as a key reason.

PayPal Australia general manager for payments, Andrew Toon (pictured) said launching with no late fees is “the right thing to do” for customers and will help deliver a better experience.

“We are backing the strength of our systems to determine consumer suitability for PayPal Pay in 4 and we believe we have the right measures in place to support our no late fees approach,” he said.

“Our business model does not rely on late fee revenues, and we believe that many people who miss a payment do so by mistake, not design. By removing late fees, we are providing our Australian customers with a secure buy now, pay later service without the risk of being penalised for late payments.”

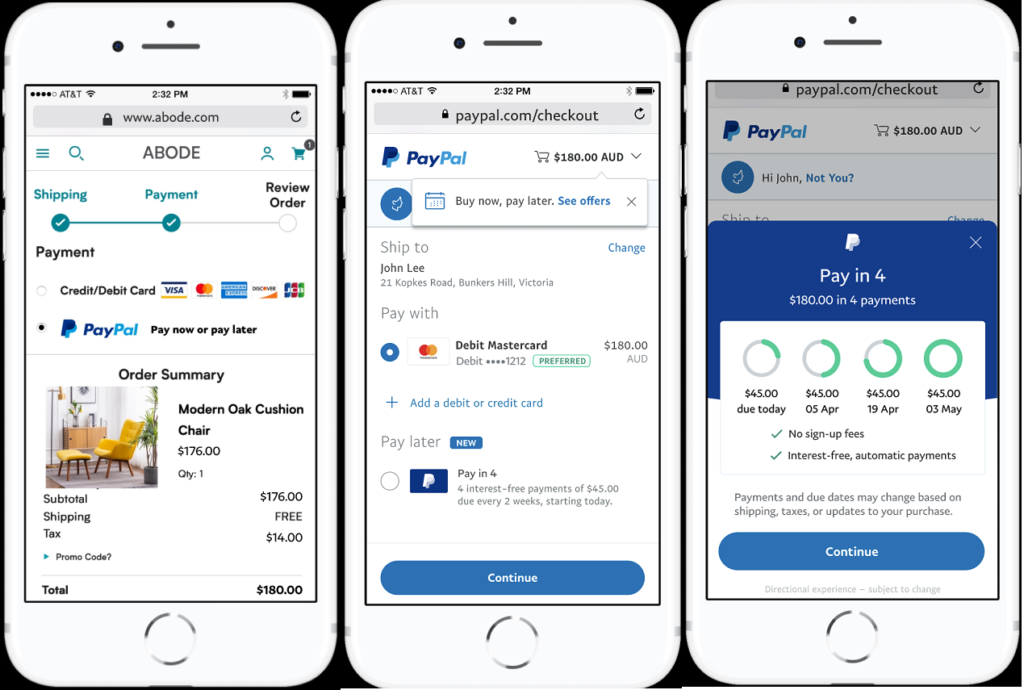

PayPal Pay in 4 is accessible to consumers in two ways. When an eligible consumer pays using the standard PayPal ‘button’, it will appear at checkout in the PayPal wallet as a payment option. Businesses can also present PayPal Pay in 4 as a distinct payment option that’s directly ‘clickable’ on their website.

As PayPal Pay in 4 is a payment option within the PayPal wallet, it will be available for consumers to use almost everywhere PayPal is accepted.

“Our primary driver is to make the PayPal wallet the most versatile and useful digital wallet available by giving more payment choice and flexibility to our customers while maintaining the highly secure processes they know and trust,” Toon added.

The trusted security and protections offered by PayPal apply for transactions made using PayPal Pay in 4. Eligible purchases are covered by PayPal’s Buyer Protection, meaning that if a product does not arrive PayPal can refund the full purchase price, including delivery.

PayPal Pay in 4 is available at no additional cost to PayPal business customers, beyond their existing account arrangements. The solution is automatically included with PayPal Checkout integration and Braintree integrations that use PayPal’s latest JavaScript Software Development Kit.

With a single integration, PayPal business customers can also add PayPal Pay in 4 messaging to their site, so consumers are aware of their flexible payment options. PayPal Pay in 4 messaging will dynamically show the individual instalment amounts based on what the customer is browsing or purchasing. Businesses also benefit from PayPal’s advanced decisioning process to prevent fraud while underwriting shoppers and they will be covered by PayPal’s Seller Protection for eligible transactions.