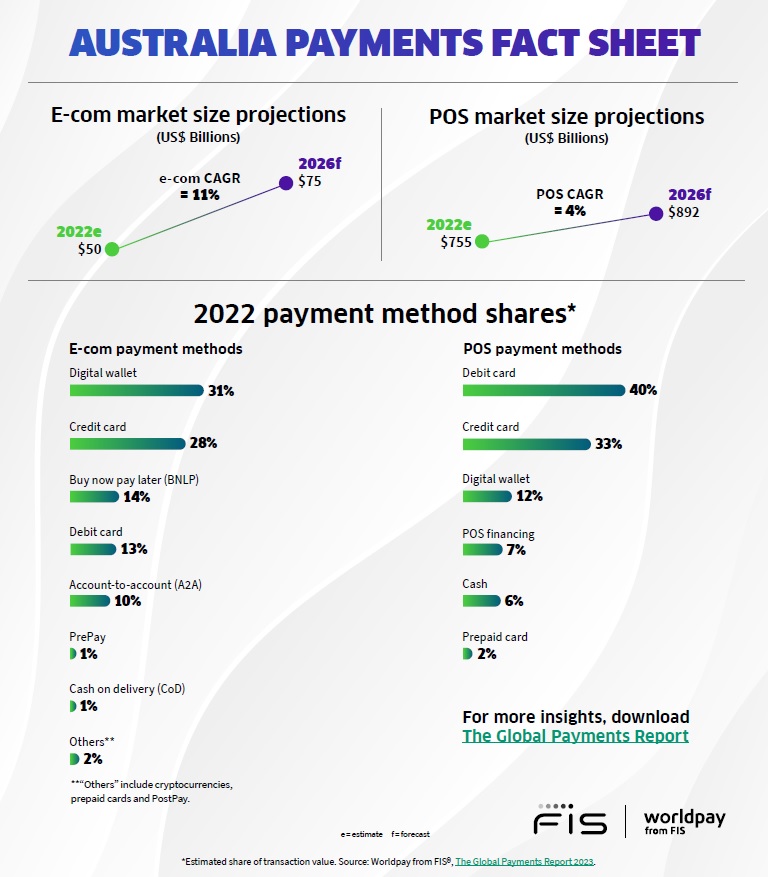

Digital wallets have become the leading online payment method in Australia – overtaking credit cards for the first time – accounting for close to one-third (31%) of e-commerce market share in 2022, versus credit cards at 28%, a new report released by global financial technology leader, FIS has shown.

Digital wallets are also the fastest growing payment method at point-of-sale, with transaction value expected to grow 83% from 2022 to 2026.

BNPL accounted for 14% of e-commerce market share in 2022, the highest in the APAC region, and is predicted to hold its market share through to 2026. BNPL’s popularity remains, with over 20 local providers plus major international brands competing for a share of the Australian consumer wallet.

Australia also has the highest share globally in POS financing (comprised of BNPL and retailer/bank financing), which was 7% in 2022.

Australian consumers continue to move away from cash, which represented 6% of POS market share – the lowest in APAC and second only to Norway (4%) among markets covered in the report.

Based on expected market uptake of the newly launched PayTo, which allows merchants to initiate real-time payments from their customers’ bank accounts, the e-commerce transaction value of account-to-account (A2A) payments is projected to double to over US$10.3 billion by 2026.

Worldpay from FIS general manager for Asia Pacific, Phil Pomford said, “BNPL has established itself as a key payment method in the Australian market and is now entering its next phase of evolution. Home to BNPL innovators such as Afterpay and Zip, Australia continues to lead the way in innovation in the new BNPL 2.0 era, with both big banks including Westpac and emerging vertical specific providers entering the field.

“While headwinds including rising inflation and interest rates are challenging BNPL core fundamentals, consumer’s interest in alternative credit remain high, especially in tough economic times. Total transaction value is expected to grow, and we see BNPL holding market share in the years to come, as indicated by our report.

“As the market diversifies, and with new regulation expected to bring BNPL more firmly in line with legacy consumer credit products, we believe it is set to remain an essential element of the payment mix in a broad range of merchant verticals.”