CreditorWatch has rolled out its automated debt collections solution, CreditorWatch Collect, providing businesses with the ability to transform their accounts receivables and collections processes, to get paid faster while saving time and money.

CreditorWatch’s January 2023 Business Risk Index shows that B2B trade receivables are at their lowest point since January 2015, with trade payment defaults increasing to 39% year-on-year. The optimisation of collections is a critical component of credit risk management and businesses need better tools to improve their accounts receivable success rates to avoid cash flow challenges.

CreditorWatch Collect extends CreditorWatch’s range of B2B credit risk management solutions that now spans across customer onboarding and assessment tools, credit risk monitoring, through to debtor assessment and automated collections. The tool provides a new way of collecting debts and empowers businesses to reduce overdue invoices, helping them get paid up to 14 days faster, while giving visibility over debtor account details to identify potential risk.

CreditorWatch CEO, Patrick Coghlan said, “The upward trend in trade payment defaults, in particular, should be of concern to business owners. Businesses need to ensure they are getting paid on time to ensure they can pay their own liabilities and have sufficient working capital to maintain their operations and grow.”

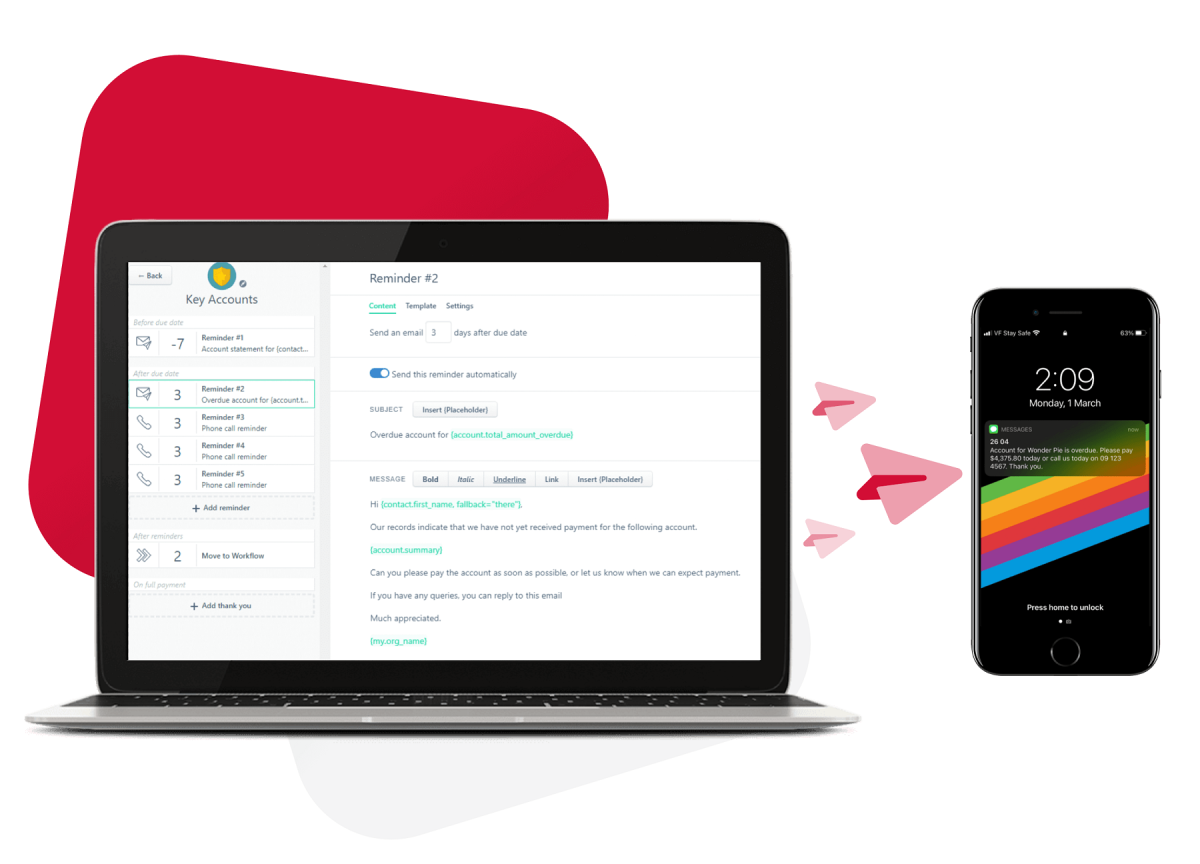

CreditorWatch Collect head, Matt McFedries added, “By providing direct connectivity to major accounting tools, customisable workflows, automated reminders and call queues, we’re helping businesses transform collections to become an efficient and scalable function that allows business owners and finance teams to focus on other important work.

“We know that business owners and finance teams can be inundated with large volumes of outstanding invoices but don’t have enough time to follow up every account. CreditorWatch Collect reduces this burden by automating the collections process on an account level in an intuitive, customer friendly way to help businesses recover outstanding debt faster.”