For retailers that have a CommBank business account, along with a merchant facility, the bank is offering a 4% bonus payment for every StepPay buy-now-pay-later payment made until December 31, 2021.

Every time a customer uses StepPay, the retailer will be credited 4% of the transaction, explains CBA group executive of business banking, Mike Vacy Lyle.

It’s an aggressive marketing move from CBA as it aims to take a larger market share of the booming BNPL market.

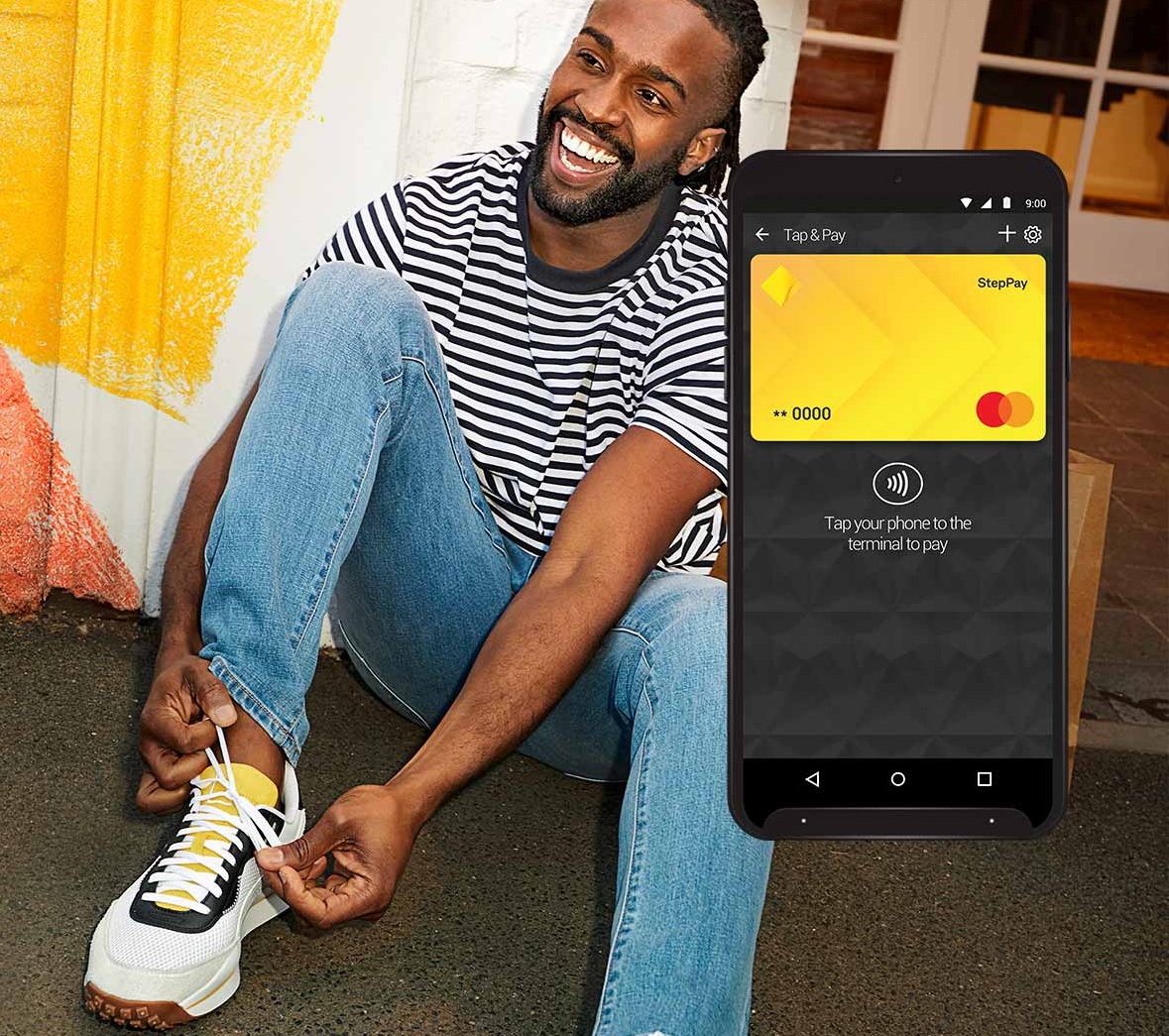

StepPay is a digital card available to CBA customers through the bank’s app. It allows them to split payments of $100 or more into four repayments

Each retailer can make a maximum of $5,000 from the credited payments until the end of the year.

CBA general manager of merchant solutions, Karen Last told RetailBiz, “What we’re hearing is that there are lots of merchants who see the attractiveness of BNPL. The appetite around using it is good. We’re seeing about half of all merchants believe that it would increase their sales, but we’re only seeing most customers shy away from it believing it’s too complex or expensive.

“In the market, we see rates between 4% and 7% being charged per sale for BNPL. Our BNPL solution just has merchant fees, no additional fees.

“In addition to that, there are selective retailers who have access to BNPL solutions. StepPay is on Mastercard, available everywhere Mastercard is.

“For smaller merchants who can’t afford, or go through the hassle of other BNPL, they get the benefits without having to activate it.”

As part of a broader push to retail merchants, CommBank has also recently introduced a single-rate transaction price of 1.1% for all in-store card transactions, giving retailers a much simpler ability to pass on payment costs for cards. That includes debit, credit, or Amex.

Last says, “We were hearing from customers that they want something simple, transparent, and competitive. Merchant pricing isn’t easy to understand, which follows on to being able to forecast your cash flow.

“We believe 1.1% is the most competitive carded rate in the market.”

Vacy Lyle says, “Some businesses, particularly small businesses, have been hesitant to offer BNPL because of the traditionally high fees. StepPay doesn’t charge additional transaction fees. With no additional merchant costs or integration costs, StepPay is a win for small businesses and levels the playing field to allow them to better compete.

“The additional four per cent bonus offer will put extra money back into businesses. We encourage our customers interested in StepPay to see how they can use it to support their favourite local or smaller Aussie business.”