Global financial technology platform, Adyen has further advanced its digital authentication solution, with ongoing pilots realising a conversion uplift of up to 7%.

Engineered to optimise authorisation and therefore end revenue, the company’s expanded capabilities include Delegated Authentication, Data-Only, and Trusted Beneficiaries functionalities. By turning regulatory challenges into opportunities, Adyen’s authentication ecosystem combines security and seamless checkout experiences.

“At Adyen, we are constantly identifying opportunities to drive better outcomes for our merchants, and optimising authentication is key to increasing conversions. Our new advanced authentication solution combines authentication, authorisation, and risk management capabilities, to optimise transactions,” Adyen Australia and New Zealand country manager, Hayley Fisher said.

In regions where Strong Customer Authentication (SCA) is required, Adyen has implemented its Delegated Authentication technology as an additional option to streamline authentication while remaining compliant.

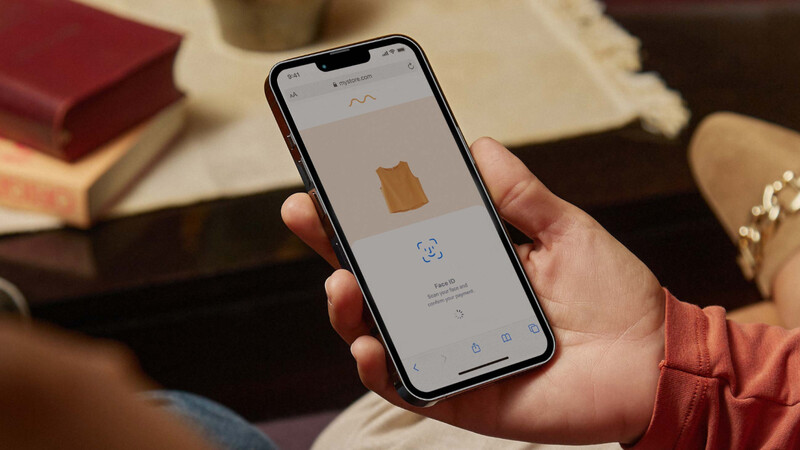

Delegated Authentication allows Adyen to fully authenticate the consumer on behalf of the issuer, providing a streamlined cardholder experience while remaining within the merchant checkout page. It enables shoppers to utilise two-factor authentication, leveraging biometric checks such as fingerprint recognition and facial scans, and device bound credentials. Delegated Authentication has been expanded from only web browser users to include iOS and Android users.

Adyen has also advanced its Trusted Beneficiaries functionality, giving shoppers the option to simultaneously add a business to their list of trusted companies in the checkout stage. After designating a business as ‘trusted,’ shoppers will not need to be re-authenticated when purchasing from them.

Even in regions where strict authentication regulations are not in place, Adyen is using its global expertise to improve authorisation rates using its Data-Only feature. When a transaction is executed where customer authentication is not mandatory, such as in the US or Brazil, Adyen can share authentication data with schemes to help them make more informed authorisation decisions.