Temple & Webster CEO Mark Coulter.

After a tough IPO two years ago, Australian online retailer Temple & Webster is on the path to profitability, with CEO Mark Coulter predicting a maiden profit in 2019.

When online retailer Temple & Webster listed on the ASX at the end of 2015, it was on a mission to shake up the Australian furniture and homewares industry. Just four years old, the company had pursued an aggressive growth strategy that saw it acquire Milan Direct and Wayfair Inc., and seemed set for success. However, the IPO tanked with shares falling as much as 33 per cent on the first day of trade.

If anything, the business was a victim of its own ambition. It was operating three brands—Temple & Webster, Milan Direct and Zizo (the rebranded Wayfair platform)—which each had their own websites and teams, and had also started opening physical showrooms.

“We needed to raise some money and the IPO was an interesting story,” Temple & Webster co-founder and CEO Mark Coulter told RetailBiz. “The basics of Temple & Webster were always there—we always cared about our customers and we were still number one in our category—but the public market story didn’t work out as planned.”

Coulter founded the business with three friends—Adam McWhinney, Conrad Yiu and Brian Shanahan—in October 2011 as a members-only marketplace. The group shared a love of homewares and had backgrounds in digital media, and saw an opportunity to do furniture in a different way.

“There was no one doing homewares and furniture well, no one tried to make it emotional,” Coulter said. “Our original model was to use content and emotion to sell furniture and we became the largest online retailer in our category within a couple of years.”

Coulter left the operations side of the business in 2013 to work on other projects, including co-founding Parcel Point and Fluent Retail. He returned in 2016 as CEO to help rebuild following the IPO.

The main problem Coulter saw was that the company was doing too much. He put a strategy in place that focused on doing one thing well, and made the decision to consolidate. They kept the Temple & Webster brand, Wayfair’s tech platform and added Milan Direct’s sourcing capabilities.

“This made the business much simpler and allowed us to improve margins and improve customer experience, delivering on our vision of making the world more beautiful.”

The platform also changed from a members-only shopping club to an online marketplace, which Coulter saw as a more sustainable model. This meant the company was no longer relying solely on email to acquire customers and could cater for planned purchases.

“The bulk of buys in any category, and especially in our category, are planned purchases, and a membership club with a limited range and stock changing every day doesn’t allow you to service that segment.”

Path to profitability

These changes look to be working. Temple & Webster is on track to reach profitability in calendar year 2018, with FY19 being the first full year of profit. In its half year results to 31 December 2017, Temple & Webster reported bottom line improvements driven by revenue growth, improved margins and cost base initiatives. Operating costs were down $3.2 million or 17 per cent.

“The business is now integrated with a simple USP around range, inspiration and service. We’re a market leader in these: we have the biggest range, the most inspiring content, and the best customer service as attested to by productreview.com.au.”

Going offline and growing online

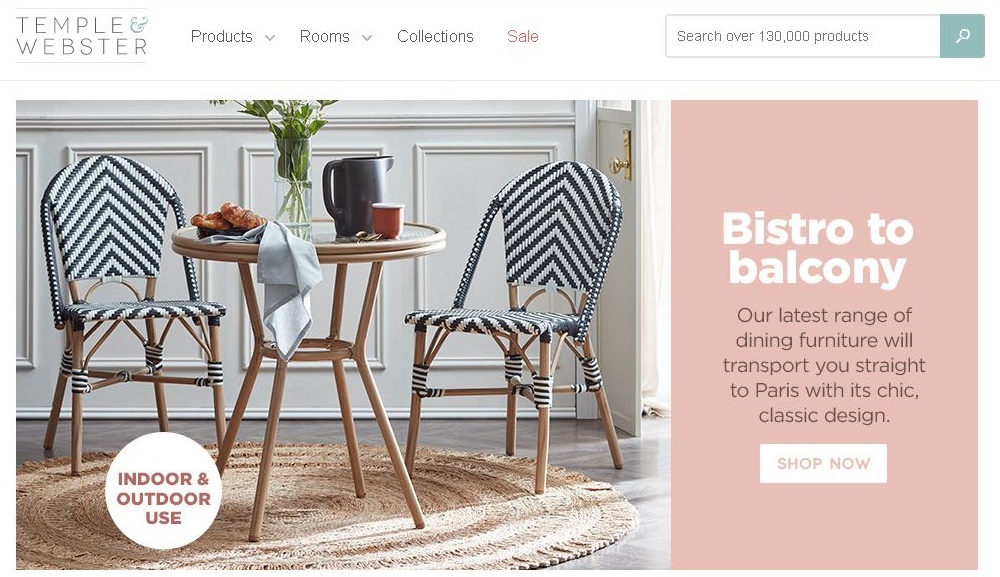

Opening bricks-and-mortar stores is a logistical challenge for Temple & Webster. The company sells 130,000 products online and Coulter said he believes having a big range is crucial to the retailer’s success. However, the ability to touch and feel product is important for some of its categories.

“It’s a problem for some categories—for example sofas above a certain price point—which does need to be solved. We do as much as we can to make the shopping experience seem seamless, but for some categories having a touch and feel experience can be useful.”

Delivering these bulky items also poses a challenge and Coulter pointed to John Winning’s Appliances Online as a business he would like to emulate in this space. “Appliances Online has a simple USP—they have a good range of product, good prices… [but] the most important thing is the service. They have on time, friendly delivery people who will take away your old washing machine and install a new one.

“That is when online becomes offline, when delivery comes to your front door. Bulky is a very hard delivery proposition. Appliances Online has had to do it themselves and we’d love to emulate that success.”

Approximately 80 per cent of Temple & Webster product is sold through a drop ship arrangement, with goods shipped directly from the supplier to the end consumer. The other 20 per cent is imported directly from over 100 factories throughout Vietnam and China, either under the Temple & Webster or Milan Direct brands.

Temple & Webster sells 130,000 products online.

The retailer currently has a showroom in Melbourne and will probably open more locations, but the focus is also on getting more consumers to shop online for furniture.

“There’s a long way to go… Only five per cent of furniture in Australia is sold online, in the UK it’s more like 12 per cent,” said Coulter. “Part of our job as a market leader is telling more people they can shop for their homes online.”

In part this shift will come from demographic change, with the oldest millennials turning 35 and buying homes. These consumers have grown up doing everything online, from buying fashion to banking, and Coulter said homes are the natural next category.

No matter where customers shop, whether in a showroom or online, they want the best experience. As such, Coulter said it would take a lot of work for Temple & Webster to expand its physical presence in a meaningful way.

“It may be important for some retailers to have both channels, but my advice is to make sure you do both incredibly well but not both average. We’re definitely an online retailer first and foremost; to rollout offline to a greater scale we’re going to have to develop expertise and really make that sing.”

Future forecast

Looking ahead, Coulter said Temple & Webster will keep working towards its vision of making homes more beautiful, one room at a time. This means having a better and bigger range, continuing to inspire customers with editorial-style product imagery and initiatives like the online Temple & Webster Style School, and constantly improving service.

“Phase one of our turnaround journey is complete. All acquisitions have been successfully integrated and we have improved the economics of the business across the board while retaining our revenue base and online market leadership.

“Our plan is to accelerate our growth through the relentless execution of our vision and by leveraging the scale of being the market leader. We will also continue to invest in new growth opportunities such as showrooms, click-and-collect locations, our trade and commercial division and building out adjacent categories, which is setting the business up for healthy growth for years to come.”

Get the latest on the art and science of retailing delivered straight to your inbox. Sign up to the weekly retailbiz newsletter.