RetailBiz for Friday 11 April 2014 – with Tess Bennett

The board of David Jones has endorsed a $2.15 billion takeover offer from South African based retail group Woolworths. In response to the news, Myer has withdrawn its proposed “merger of equals” offer.

Under the proposed deal David Jones shareholders will receive $4 per share, a 25 per cent premium on the shares closing price yesterday of $3.19, according to a statement released by the company today.

The deal will require approval from Treasurer Joe Hockey under Australia’s foreign investment rules and support from shareholders, however the board of directors have unanimously recommended shareholders accept the proposed deal.

David Jones Chairman Gordon Cairns said, “This is a compelling proposal which represents a significant premium to not only our intrinsic value but also to broker valuations and to recent share prices. It represents a substantial earnings multiple.”

According to the company the proposal was accepted “in absence of a superior proposal,” implying it is a more attractive offer than the merger first proposed by Myer in October 2013.

Mr Cairns said, “In reaching our conclusion that the proposal is in the best interests of shareholders, customers and employees, the board has considered a number of alternatives, including standalone value creation opportunities; realising the value of the freehold properties owned by David Jones; or pursuing a merger with Myer in accordance with its proposed terms.

“Upon assessing the alternatives before it, the Board has unanimously concluded that the Woolworths offer is a compelling option which realises value for our shareholders.”

In a statement released today by Myer, the company said it would advise “David Jones today of the withdrawal of our proposed merger of equals” despite believing “in the strategic merits of our proposal and the potential value accretion for both sets of shareholders.”

CEO Bernie Brookes said, “Myer remains fully committed to continuing to progress our well established five-point plan with a number of new initiatives to drive sales and profitability while continuing to invest in the growth areas of the business.”

“As we move into FY2015 we expect to benefit from a number of strategic initiatives including new stores, major refurbishments, growth in exclusive brands and the online business. Myer remains Australia’s largest full-line department store business and will continue to be a robust competitor,” Brookes said.

Support for the bid from the David Jones board and shareholders is subject to the findings of an independent expert’s review of the scheme, expected to be released in May 2014.

Woolworths, which is unrelated to the Australian supermarket chain, will also need approval from shareholders and the South African Reserve Bank.

It is expected both sets of shareholders will vote in June 2014 and, if approved, the scheme will be implemented in mid-July 2014.

Woolworths’s Chief Executive Officer Ian Moir said, “We believe that David Jones is a truly iconic Australian retail business. Woolworths is a very similar business, closely aligned in terms of our target markets and our values. The combination will create a leading southern hemisphere retailer with meaningful scale, able to leverage common fashion seasonality with enhanced sourcing capability.

“We will work with the David Jones team to deliver the sound strategies they have already set in place. Woolworths will bring extra capability, financial strength and significant scale to accelerate these strategies and offer a greatly enhanced value proposition, delivering on-trend product within the most exciting and innovative shopping experience in the market.”

In South Africa, Woolworths is a chain of stores selling clothing, food, homeware, beauty and financial services under its own brand name. Woolworths also owns 88 per cent of Country Road Limited, a leading clothing and homeware retailer listed on the ASX.

Quote of the Day

“Until now, viewers of Jamie Oliver recipes had to make a list of the ingredients they needed to buy for a recipe when they did their shopping. With our technology, shoppers can immediately add the ingredients to their online shopping basket at Woolworths with just a click of a button.”

Foodity CEO Johnathan Agnes explains the new technology being implemented on the Woolworths website that makes it even easier to purchase food to replicate Mr Oliver’s most delectable meals.

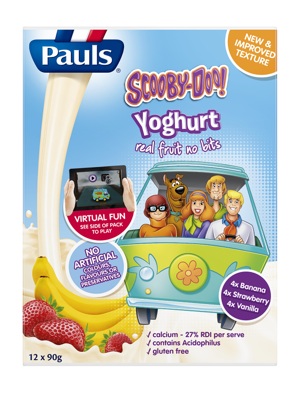

Image of the Day

According to the spiel, "Pauls has teamed up with Warner Bros. Consumer Products to create a new delicious Scooby-Doo yoghurt featuring on-pack augmented reality technology, bringing everybody’sfavourite detectives to life". And parents would be able to get away from this if it weren't for the meddling kids…