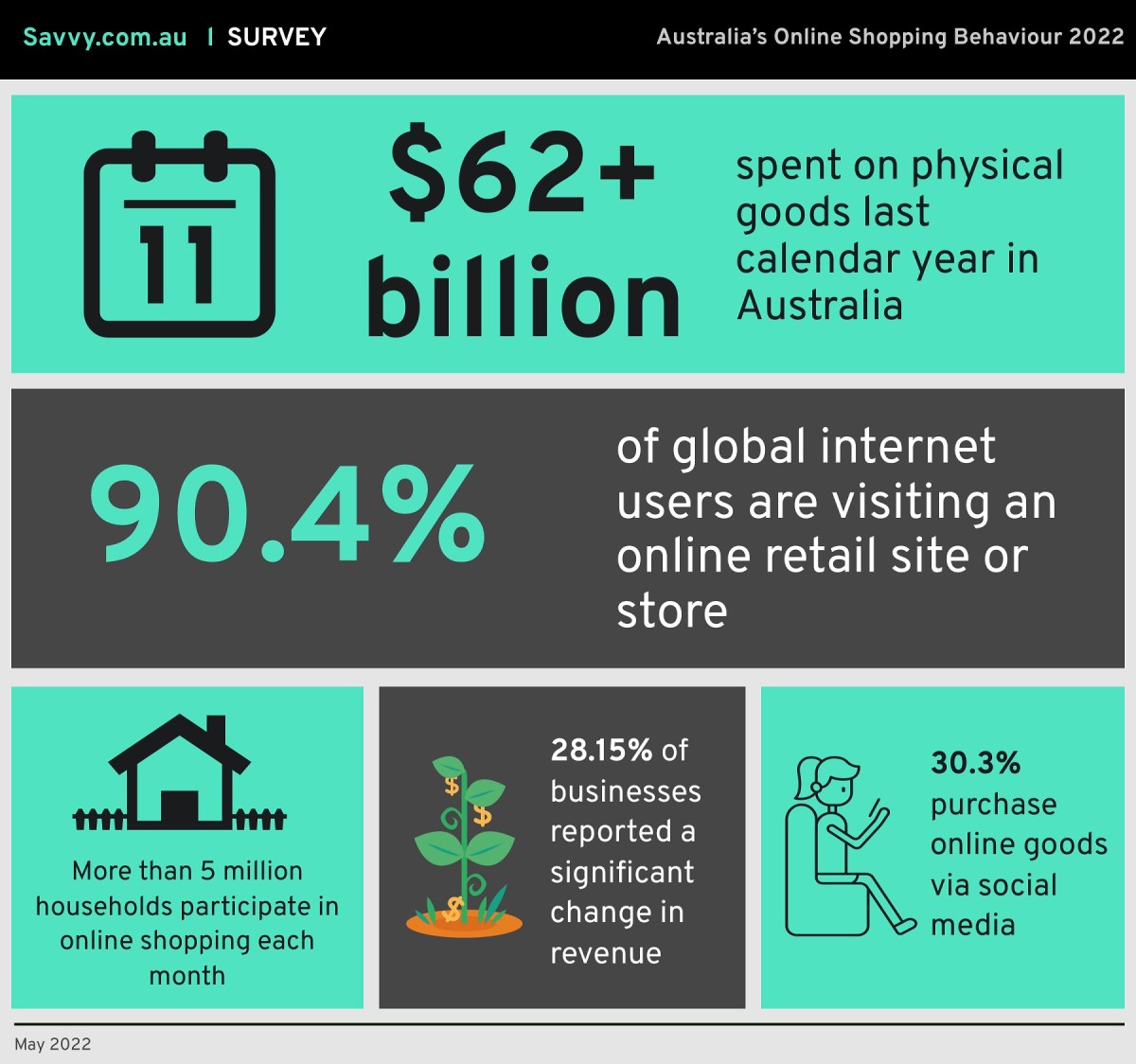

Australian comparison service, Savvy has released a report covering Australia’s online retail and shopping behaviour for 2022, which has confirmed that online shopping participation will remain strong well into the future.

On average, more than five million households are partaking in online shopping each month, an increase of 39% from 2019. December 2020 recorded 5.68 million households, indicating growth since March which only saw 4.45 million shopping online.

The market size of the online shopping industry has grown 19.6% on average over the last five years between 2017 and 2022.

Compared to the rest of the world, Australia is still lagging behind in terms of expenditure and purchase frequency, despite the increase in overall online spending. For example, in South Korea, more than half (53%) of online shoppers are buying at least weekly on average, more than double Australia’s figure of 25.3%. Last year, households in Australia made online purchases at least fortnightly – an increase of 112% from 2019, from 1.6 million to 3.4 million households.

Homeware and appliances saw the highest expenditure at 23.8%, followed by department stores (16.3%), grocery and liquor (15.3%), personal and recreational (12.4%) and fashion (10.9%). Consumers spent little on games and toys at 8.9%, with even less expenditure on media (6.4%). Surprisingly, takeaway food had the lowest share of online spending at 5.9%.

Free shipping is the factor most influencing people to buy their groceries online. Over half of Australians (61%) say free shipping incentives encourage their shopping habits and provide them with a better overall shopping experience. Because of this, click & collect has grown to 13.6% due to its immediacy and minimal shipping costs.

New South Wales consumers are spending the most, with over 31% taking advantage of the convenience of online retail. Helensburgh in New South Wales is the top suburb by household spending, followed by Silverdale and Seaforth.

Victoria is not far behind at 30% with Point Cook the top buying location by purchase volume, followed by Liverpool in New South Wales and Hoppers Crossing in Victoria. Queensland also benefited from the online shopping craze at 18.1%, while Western Australia (9.1%) and South Australia (6.3%) households were not as active.

Online payment methods are where businesses are investing their e-commerce capabilities with 75% of consumers using bank cards and e-wallets to make their online purchases. 16% use bank transfers while only 5% are using cash.

Over the past 12 months, PayPal has been crowned the top payment service at 87% ahead of BPAY (61%) and AfterPay (37%), with GooglePay coming in fourth at 21%.