Consumers have embraced the benefits of safety, security and convenience from digital commerce and it’s a behavioural shift that is here to stay long after COVID-19 subsides, according to Mastercard Asia Pacific executive vice president for products and innovation, Sandeep Malhotra.

“Consumers now want on-demand products and services, whether it’s food delivery, groceries, fitness courses, telemedicine, conferencing, learning or entertainment,” he said.

“The new consumer mindset sends a clear signal to merchants that online shopping and touch-free transactions are essential to building the business and ensuring customer loyalty now and in the future.”

A new Mastercard study shows that 30% of Australian consumers plan to make more purchases online with 38% of respondents suggesting that less in-store shopping is here to stay, in addition to less cash payments.

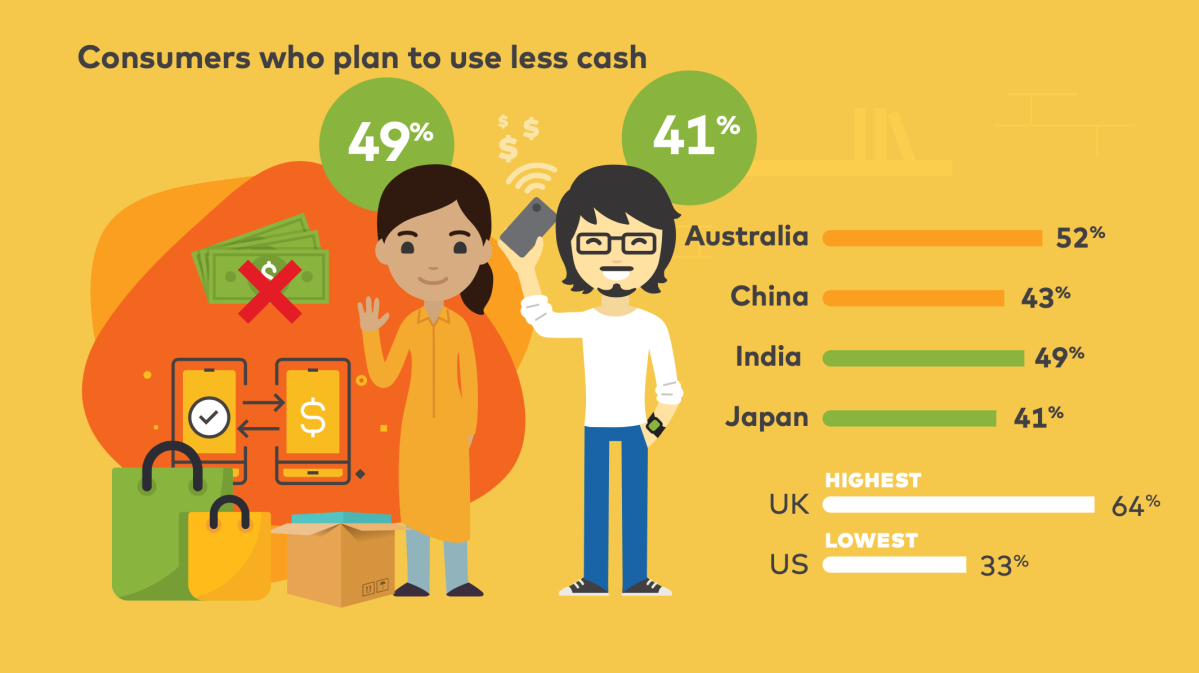

This shift is underway globally with almost 6 in 10 consumers saying the move to digital payments is likely to be permanent and nearly half plan to use cash less even after the pandemic.

“The digital economy is the future and there’s no doubt that consumers and merchants are embracing the evolution. Now that people are experiencing and expecting the security, simplicity and seamlessness of digital commerce, there’s just no turning back,” Malhotra said.

With many store closures and safety concerns, digital commerce revenues grew 20% globally in the first quarter of 2020 compared to the previous year, according to the Salesforce Shopping Index.

Mastercard works with partners across merchants, financial institutions and fintechs to create and deliver products including the launch of digital card programs with GrabPay in Singapore and the Philippines and with Hong Kong virtual banks Mox by Standard Chartered and WeLab Bank. In India, Mastercard, Axis Bank and Worldline recently launched Soft POS, an app that transforms smartphones into point-of-sale terminals.